Suriname Prepares for South America’s Next Big Oil Boom

eyesonsuriname

Amsterdam, dec 21st 2023–After grappling with a lengthy political and economic crisis the government of Suriname pinned hopes of an economic recovery on a massive offshore oil boom. French supermajor TotalEnergies and APA Corporation have made five high-quality oil discoveries since 2020 in Suriname’s offshore Block 58. The discoveries ignited dreams of a transformational oil boom for the former Dutch colony. Two years ago, Paramaribo’s vision for replicating neighboring Guyana’s colossal offshore oil boom, responsible for the economy growing threefold in five years, was almost undone. Conflicting data from drilling results and seismic modeling led to concerns regarding reservoir quality, which was responsible for TotalEnergies delaying the final investment decision (FID) for the block.

Paramaribo’s desperation to start Suriname’s long-awaited oil boom grew as the impoverished country’s economic slump worsened. Inflation spiraled into double figures, hitting a multi-year annual high of 62% during the 2020 pandemic, while the economy shrank nearly 16% that year. Despite inflation falling it was still at an elevated level with an eye-watering annualized rate of 51% reported for September 2023. This coupled with a soaring cost of living, because of the sharp devaluation of the Surinamese dollar after it was floated during June 2021, and President Chan Santokhi phasing out energy subsidies as part of IMF imposed austerity measures, sparked violent protests in Paramaribo early this year.

This crisis is rooted in the decade-long rule of Santokhi’s predecessor former military strongman Desi Boutrese, who was convicted of murder and drug trafficking. He made poor policy decisions and engaged in excessive spending, which severely weakened Suriname’s economy while allowing corruption to flourish. After years of growth, the economy entered a sharp downturn during 2015 from which it never truly recovered. Paramaribo’s fiscal weakness and a sluggish economy, which failed to recover from the pandemic contracting by 3% for 2021, combined with rising poverty placed considerable pressure on Santokhi and Suriname’s national oil company Staatsolie to kickstart Suriname’s long-awaited oil boom.

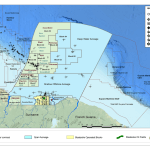

By the end of 2022, TotalEnergies and partner APA had made five major oil discoveries in Block 58. The most recent being with the Krabdagu wildcat well completed in February 2022, although the last exploration well drilled at the Awari prospect, completed in November 2022, came up dry.

Regardless of industry insiders speculating that Block 58 contains the same petroleum fairway passing through the nearby prolific Stabroek Block, several issues emerged convincing TotalEnergies to delay the multibillion-dollar FID. The main complications were that many of the discoveries had high gas-to-oil ratios and there was a slew of poor drilling results, including dry wells. This was complicated by Suriname’s worsening economic and political crisis. Even after stalling the FID TotalEnergies continued with appraisal drilling for the Sapakara and Krabdagu discoveries, which delivered significant positive results. By the end of August 2023, the French supermajor had drilled and tested three wells, leaving a total of four appraisal wells completed, which delivered favorable results.

In September 2023, TotalEnergies confirmed it had identified close to 700 million barrels of recoverable resources in Block 58 and committed to launching development studies with engineering planning underway. It is anticipated that the FID for Block 58 will be made by the end of 2024, with first production targeted for 2028, which is three years later than initially anticipated by Paramaribo. The development, estimated to cost around $9 billion, will consist of a series of subsea wells connected to a floating production storage and offloading (FPSO) vessel with the capacity to lift 200,000 barrels per day. Staatsolie, through the production sharing contract with 50% partners TotalEnergies and Apache, has the right to acquire 20% of the project once development starts.

This is an important development for Suriname. Analysts believe the former Dutch colony’s share of the offshore Guyana-Suriname Basin possesses considerable volumes of recoverable oil with the potential to launch a boom on the scale of that being experienced by Guyana. Results from seismic modeling and exploration as well as appraisal drilling indicate the recoverable oil in place in the basin exceeds the U.S. Geological Survey’s (USGS) earlier appraisals. In a May 2021 report, the USGS claimed the Guyana-Suriname Basin had fully risked mean total undiscovered oil resources of 15 billion barrels, only 4 billion barrels more than the 11 billion barrels identified by Exxon in the Stabroek Block since 2015. U.S. investment bank Morgan Stanley estimates that Surname’s Block 58 contains 6.5 billion barrels which is on the scale of the Stabroek Block.

There is also a series of other oil discoveries in the Guyana-Suriname Basin to consider. The key discoveries are the Kawa-1 and Wei-1 discoveries made by CGX Energy in the Corentyne Block, which is contiguous to Block 58, in offshore Guyana. According to a report commissioned by Frontera Energy, which is a 68% partner in the Corentyne Block and majority owner of CGX Energy, there are fully risked mean prospective resources of 967 million barrels to be discovered. APA also announced, in August 2022, that the Baja-1 wildcat well in Block 53 offshore Suriname had found oil. Malaya’s national oil company Petronas, which is the operator with a 50% interest, and partner Exxon, holding the remaining 50%, made two discoveries in Block 52 offshore Suriname at the Sloanea-1 well in 2020 and Roystonea-1 well during November 2023.

The latest developments not only indicate that Suriname’s much-hyped oil boom may finally be back on track but that there are still substantial volumes of hydrocarbons to be discovered in the Guyana-Suriname Basin. This points to Suriname having the opportunity to enjoy the tremendous economic benefits a major oil boom, such as that occurring in neighboring Guyana, can deliver. These positive developments couldn’t have come at a more crucial time for a deeply impoverished country caught in a devastating economic crisis that sees inflation running well into the double digits and poverty expanding.