What is the ideal carbon price?

Improving the already best approach to addressing climate change.

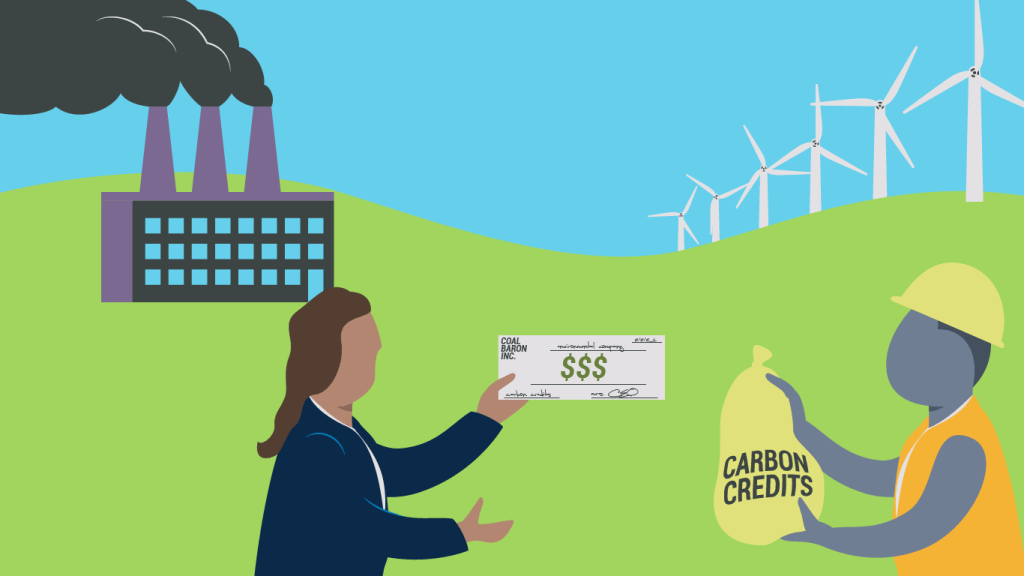

The most favored approach by economists in addressing climate change is to impose a cost on greenhouse-gas emissions. This method is deemed effective as it enables society to pinpoint the most cost-effective unit of carbon-dioxide equivalent to avoid. It is also equitable, with the polluters bearing the cost, and the revenue can be redistributed. Moreover, it supports other decarbonization methods as companies are required to monitor their emissions, and investors must determine which of their assets are the most polluting when complying with a carbon price.

Carbon Pricing Initiatives Reach Record High Globally, with China Leading the Way

The World Bank reports that carbon-pricing initiatives have now reached 73 globally, encompassing 23% of total emissions – a significant increase from just 7% ten years prior. The schemes include both emissions-trading, where permits can be traded in a market, and carbon taxes, where governments set a direct price. The largest of these efforts is China’s newly launched scheme, covering 9% of global emissions through its energy sector. Even in the US, where federal support for carbon pricing is lacking, more states are establishing their own initiatives – such as Washington, which launched an emissions-trading scheme in January.

The Disillusionment of Centre-Left Economists with Carbon Pricing: Why They Believe It’s Not Aggressive Enough

However, a growing number of economists on the centre-left, who would typically support carbon pricing, have become disillusioned with the policy. These critics argue that carbon prices are insufficiently aggressive for two reasons. Firstly, even though the EU’s emissions-trading scheme is one of the most comprehensive, it excludes buildings and transport while providing allowances to airlines and heavy industry to maintain competitiveness. Prices in Europe are relatively high, reaching a record €100 ($107) per tonne of carbon-dioxide equivalent in February, but they are too low elsewhere. Secondly, the World Bank estimates that less than 5% of emissions are currently priced at or above the level required by 2030 to limit temperature increases to 2°C above pre-industrial levels.

Equity Concerns in Carbon Pricing: How the Burden Falls on the Poor Instead of Polluters

The critics’ second concern, which is equity, is reflected in this tentative action. They contend that the burden of carbon prices is unfairly borne by the poor instead of the polluters. Such actions result in increased energy prices, which typically affect only the energy sector, and cause industrial jobs to move overseas, making them exempt from emissions-trading programs. Politicians dilute these programs in anticipation of backlash on these grounds. As a result, the emissions reductions that were promised do not come to fruition.

Understanding the Complexities of Assessing the Impact of Carbon Prices

These are the points of contention. How does the proof compare? Assessing the impact of carbon prices is a complex task. Carbon prices, like interest rates, have a dual effect on and are influenced by the economy. All things being equal, an increased carbon price will decrease economic activity and increase consumer prices. However, a vigorous economy will also result in an increase in the price of a carbon permit. Politicians may also feel more at ease with increasing carbon taxes during a period of economic prosperity. They may take measures to reduce them during tough times. For example, in May of last year, the European Commission announced an auction of surplus permits during the energy crisis that followed Russia’s invasion of Ukraine, in an effort to lower prices.

Using Synthetic Control Technique to Evaluate the Impact of a Top-up Tax on the EU’s Emission Trading Scheme: Insights from Marion Leroutier’s Study

Fortunately, there are methods available to distinguish between cause and effect. Marion Leroutier, a researcher at the Stockholm School of Economics, has employed a “synthetic control” technique to examine the impact of a top-up tax on the EU’s emission-trading scheme, which was implemented by the UK in 2013. To assess the effect of this increased carbon price, Leroutier has created a hypothetical version of the UK that did not introduce the tax by utilizing data from other EU countries, similar to a control group in an experiment. Although interconnectors enable the UK to import electricity from neighboring countries, which may also be subject to the treatment, Leroutier has taken into account estimated “spillovers,” and has concluded that the tax resulted in a 20-26% reduction in emissions from the energy sector.

Carbon Taxes: Effective in Reducing Emissions with Minimal Economic Impact, Study Finds

Gilbert Metcalf from Tufts University and James Stock from Harvard University will soon release a paper that aims to consider the wider economic implications. Their investigation focused on 31 European nations, taking into account previous emissions and economic development to identify any discrepancies in carbon pricing that cannot be attributed to the state of the economy. The research reveals that carbon taxes decrease greenhouse gas emissions, which is consistent with the predictions of economists. Moreover, the study indicates that the impact on economic growth and employment is minimal, with no discernible positive or negative effects. This could be due to more innovation occurring than anticipated.

Event Study Reveals Impact of Carbon Prices on Emissions and Innovation, but at a Cost

One way to distinguish between cause and effect is to utilize an “event study”. This method is commonly used to evaluate the consequences of monetary-policy decisions. By examining the immediate response of carbon prices to a policy announcement, it becomes feasible to eliminate the influence of underlying economic conditions that do not fluctuate at the same pace. The impact of the price change can then be monitored throughout the economy. In a recent working paper by Diego Känzig from Northwestern University, this approach was employed, and it was discovered that elevated carbon prices lead to decreased emissions and promote environmentally-friendly innovation. However, these advantages come at a price. The increased costs of energy resulting from the higher prices have a negative impact on the finances of low-income individuals.

Did we get the green right?

The use of carbon prices has effectively reduced emissions, although they could be made more acceptable. Mr. Känzig’s research contrasts the EU’s emissions-trading scheme with national carbon prices. Although national taxes may result in leakage, with polluting activity shifting to other countries, they have a lesser impact on the economy, reducing opposition from centre-left critics. This is because the generated revenue is often used to provide tax cuts, which can be targeted towards low-income individuals.

Carbon Taxes and Emissions-Trading: A Solution for Climate Change and Economic Growth, but What about Recycling?

According to the World Bank, governments can expect to generate $100bn through carbon taxes and emissions-trading schemes this year, with the figure set to increase as such schemes become more widespread. This revenue will aid in addressing the perception that these measures are not forceful enough. However, to counter the argument that they negatively impact the less privileged, policymakers need to recognize the significance of recycling.