Revitalising the Tourist Industry in Indonesia

Nicholas Morris / eyesonindonesia

The recently-published Indonesian Long-Term Development Plan (RPJPN) sets ambitious targets for Indonesia in 2045, under the heading “(Golden) Indonesia EMAS”. The plan is to achieve per capita income equivalent to that of developed countries (around US$3,000); eradicate poverty and reduce inequality; increase the influence of Indonesia in the international arena; enhance the productivity of human resources; and reduce greenhouse gas emissions so as to achieve ‘net zero’ by 2060. Recognising that ‘bold moves’ are needed to prevent Indonesia falling into the “middle income trap”, the plan includes numerous strategies to boost resiliency, foster prosperity, strengthen inclusivity and advance sustainability.

Indonesia is well-placed to succeed over the next 40 years, with a large, young workforce (“the demographic dividend”); a digitally savvy population (the 4th highest number of internet users globally); strong domestic demand from a population of some 275 million; huge natural resources and biodiversity; and a strong entrepreneurial spirit in its small and medium enterprises (MSMEs) (which employ 97% of Indonesians). However, challenges include lower productivity than other ASEAN countries; concentration of skilled talent in Java; underdeveloped transport and logistics infrastructure; and the dominance of basic goods and services in Indonesia’s exports.

Tourism and the creative industries, which currently contribute around 10% of Indonesia’s GDP and employ some 45 million people (around 16% of the population), have been selected as one of the key sectors which could drive Indonesia’s future success. At present, some 57% of domestic tourism occurs in Java, while 77% of international tourists go to Bali and NTT. There is enormous scope to develop other regions, both for domestic and international tourists. However, there are again challenges including that public transportation lacks connectivity, especially for rural areas, and inter-city highways are severely crowded. Compared to neighbouring countries, Indonesia lacks high-quality accommodation options, and faces problems with waste disposal, and water and electricity supply. There are fewer airports connected directly to the places holidaymakers live than Malaysia, Japan, Singapore, Thailand and China.

A particular focus is on ‘Ecotourism’. Indonesia’s aspiration is to provide true world-class tourist destinations with a developed eco-tourism strategy in nature and culture-rich areas. These will be supported by integrated, efficient, transport and logistics infrastructure. A ‘Tourism and Creative Industries’ roadmap has been developed, which includes providing incentives to empower local communities to develop small tourism businesses. Systems are being established to certify tourism sustainability practices, and world-class players are being encouraged to develop accommodation and surrounding infrastructure. For the creative industries, boosting export sales will include national branding (“Made in Indonesia”) with strict quality control.

The roadmap sets a number of key metrics for development of the tourist industry, including expanding the number of foreign tourists from less than 2 million per year today, to 15-20 million by 2045 (which would match what Thailand has achieved). The number of domestic holiday trips is planned to rise from around 600 million today to some 1,500 million by 2045, with an average spend per trip rising from $150 to $250, also by 2045. Indonesia’s share of world exports of creative goods is projected to rise from less than 1% today to 3-5%, with the contribution of the creative industries to GDP rising from 4% to 8% by 2045, and a corresponding rise in the average income of creative industry workers.

At the recent World Travel and Tourism Council’s global summit in Riyadh, Saudi Arabia, Sandiaga Uno, Indonesia’s Tourism Minister, emphasised a change of approach:

“We’re not only focusing on sun, sea and sand – the three S that we’ve been so famous for – we are adding serenity, sustainability and spirituality”

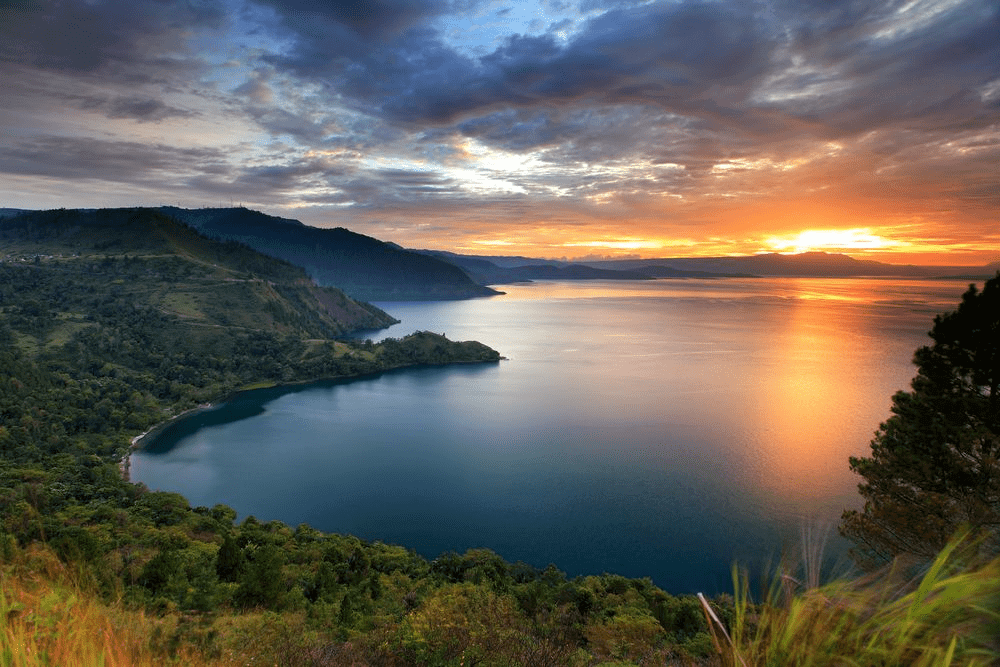

The new strategy is focused on five ‘super priority’ destinations: Lake Toba (the world’s largest crater lake); Borobudur (the world’s largest Buddhist monument); Mandalika (a new development project in Lombok); Labuan Bajo (the gateway to Komodo National Park); and Likupang in Sulawesi. Bali, Indonesia’s tourist ‘jewel in the crown’, is taking active steps to fix its waste, water and electricity problems, and has plans for a new cross-island toll road, and much better public transport. Five more priority destinations that are also receiving attention are Belitung, Tanjung Lesung, Morotai, Wakatobi and Raja Ampat.

Nicholas Morris

18th March 2024