Fitch Upgrades Suriname’s LT-FC IDR to ‘CC’

Fitch Ratings – New York – 16 Jul 2020: Fitch Ratings has upgraded Suriname’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘CC’ from ‘RD’. Fitch has also upgraded the issue rating on Suriname’s 2023 notes to ‘CC’ from ‘D’.

KEY RATING DRIVERS

The upgrades follow the completion of the “consent solicitation” to reschedule the principal payments of Suriname’s 2023 notes and amend the terms of the related accounts agreement, which Fitch deems to constitute the execution and completion of a distressed debt restructuring.

The ‘CC’ LT-FC IDR indicates a broader restructuring of Suriname’s FC debt is probable, reflecting the government’s high government debt burden, acute shortage of foreign currency and distressed financing conditions. Moreover, in its manifesto, the Progressive Reform Party (VHP), which is the leading political party in the new government, indicated debt rescheduling as one avenue to improving government debt sustainability. At the same time, the VHP highlighted aims to strengthen government revenues, narrow the government deficit, and access sustainable financing. Fitch has affirmed the issue ratings on Suriname’s 2026 notes at ‘CC’.

On July 9, the Government of Suriname obtained agreement from creditors to reschedule the first USD15 million principal payment on the USD125 million 2023 notes originally due June 30. The amended amortization schedule slates the first principal payment of USD15 million on Dec. 30, 2020 followed by six semi-annual instalments of USD18.3 million. Alternatively, if the government formalizes an IMF funding arrangement including policy benchmarks by Dec. 30, 2020 under the amended terms, the notes will amortize in six equal payments starting June 30, 2021. Further changes to terms relating to the state oil company dividend grant the sovereign greater FC cash flow flexibility. By July 13, the government had paid a USD624,000 “consent payment” to noteholders and cured the USD8.0 million interest coupon due June 30, which had fallen into a 30-calendar-day grace period.

The government remains current on the USD550 million 2026 notes with a bullet maturity. The next USD25.4 million semi-annual interest coupon on the 2026 notes is due Oct. 26, 2020.

Fitch views the risk of a broader restructuring of FC debt as probable, reflecting the government’s high government debt burden, acute shortage of FC and distressed financing conditions. Large government cash deficits averaging 10.4% of GDP during the past three years (2017-2019) have increased Suriname’s high government debt burden, which Fitch expects to exceed 100% of GDP at the end of 2020 up from 80% of GDP in 2019. Over three-quarters of the debt is denominated in foreign currency, rendering it vulnerable to devaluation of the Suriname dollar.

Amid limited net external disbursements and commercial bank exposure to the government near 9% of GDP at the end of 2019, the central bank ramped up lending to the government, providing net financing totaling 16% of projected annual GDP during January-June 2020 and raising the stock of government liabilities held by the central bank to 23% of GDP at the end of June, according to central bank balance sheet figures.

Suriname’s external liquidity is exceptionally low with unrestricted international reserves (including gold) at USD188 million in May. Suriname’s international reserves have come under pressure during 2019-2020 as a result of widened current account deficits (10% of GDP in 2019) driven by large government deficits, increased imports, and more recently low oil export prices. On the capital account, FX cash outflows have also been recorded. Net external debt is high at 58% of GDP at YE 2019, nearly double the current ‘B’ median. Fitch expects the central bank to implement an exchange-rate adjustment in the near term; the parallel exchange market continues to show a material premium over the official stabilized SRD-USD exchange rate. Macro instability followed the last large currency devaluation in 2016.

Contingent liabilities in the financial system are also material in view of an impending currency devaluation and the constraint of Suriname’s weak macro environment and deleveraging processes on financial institutions’ profitability and capacity to rebuild their capital buffers, with their return on assets has been less than 1% the past four years (2016-2019). The banks’ regulatory capital to risk-weighted capital has steadily improved to 10.5% as of July 2019 (latest available figure published in the IMF AIV staff report December 2019) up from a low of 5.5% in 2016. Non-performing loans remained elevated near 12.5% as of July 2019 (latest data).

There is also material risk that public accounts may be restated, as highlighted by the government’s information addendum dated July 1. Government liabilities were revised upward in 2016 after material government arrears to construction and other private contractors were disclosed. The latest government operational accounts are dated October 2019, although government debt reports are available through April 2020.

On July 16, Suriname inaugurated President Chandrikapersad Santokhi, leader of the VHP and a four-party governing parliamentary coalition that sat June 29. President Desi Bouterse and the National Democratic Party (NDP) conceded the result of the May 25 general elections.

The leading VHP party delineated broad macroeconomic objectives, including strengthened public finances (citing revenue and budget improvements as well as government debt sustainability) and greater macroeconomic stability (citing central bank independence and price stability) in its party platform. Fiscal adjustment faced counter-pressure during the preceding administration, which point to risks to the potential fiscal adjustment, in Fitch’s view. Peaceful public protests against electricity tariff increases immediately following a large exchange-rate adjustment resulting in double-digit inflation contributed to the derailment of Suriname’s first IMF program in 2016. The planned introduction of a value-added tax to broaden the tax base was postponed indefinitely in 2018.

The affirmation of Suriname’s Country Ceiling at ‘CCC’ reflects the deterioration of Suriname’s external liquidity and inconsistent macroeconomic policies, which Fitch views undermines the conditions for timely private external debt service payment.

ESG Considerations:

ESG – Governance: Suriname has an ESG Relevance Score (RS) of 5 for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption, as is the case for all sovereigns. These scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in Fitch’s proprietary Sovereign Rating Model. Suriname has a medium WBGI ranking at the 43rd percentile, reflecting a recent track record of peaceful political transitions, a moderate level of rights for participation in the political process, moderate institutional capacity, established rule of law and a moderate level of corruption. In November 2019, a Suriname court convicted President Bouterse for the execution of 15 civic dissidents in 1982 during the former military government he led. Following general elections in May 2020, a new Suriname parliament has elected a new President-elect, Chandrikapersad Santokhi, a former minister of justice, who will be inaugurated on July 16.

ESG – Creditor Rights: Suriname has an ESG Relevance Score (RS) of 5 for Creditor Rights as willingness to service and repay debt is highly relevant to the rating and is a key rating driver with a high weight.

SOVEREIGN RATING MODEL (SRM) AND QUALITATIVE OVERLAY (QO)

In accordance with its rating criteria, Fitch’s sovereign rating committee has not utilized the SRM and QO to explain the ratings, which are instead guided by the ratings definitions.

Fitch’s SRM is the agency’s proprietary multiple regression rating model that employs 18 variables based on three-year centered averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch’s QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within Fitch’s criteria that are not fully quantifiable and/or not fully reflected in the SRM.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to positive rating action/upgrade:

–Formulation of a credible fiscal and economic adjustment plan that avoids a debt restructuring.

–Improved outlook for external financing, such as substantial inflows of external support that do not require debt restructuring.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

–Signs that a default is imminent, for example the announcement by the new government of a debt restructuring.

–The rating for the LT Local Currency IDR would be downgraded to ‘CC’ if a default becomes probable and to ‘C’ if the government announces plans to restructure its Suriname dollar-denominated debt.

BEST/WORST CASE RATING SCENARIO

International scale credit ratings of Sovereigns, Public Finance and Infrastructure issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of three notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from ‘AAA’ to ‘D’. Best- and worst-case scenario credit ratings are based on historical performance. For more information about the methodology used to determine sector-specific best- and worst-case scenario credit ratings, visit [https://www.fitchratings.com/site/re/10111579].

KEY ASSUMPTIONS

–Fitch expects global indicators to move broadly in line with Fitch’s Global Economic Outlook forecasts;

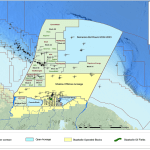

–Fitch’s baseline forecasts exclude the impact of Apache Corp. and Total S.A.’s find of significant, but as yet unquantified, oil reserves in Suriname waters on Suriname’s balance of payments (given the discovery’s early nature) as well as the first oil production (which has a roughly three- to five-year development timeline).

SUMMARY OF DATA ADJUSTMENTS

–Fitch analyzes government operations on a cash basis (which includes net payments of supplier arrears) using published Ministry of Finance statistics on arrears flows because this treatment better explains the scale of the government’s financing needs and change in government debt/GDP during 2015-2019, in our view, than the government commitment balance also published by the Ministry of Finance;

–Fitch values government debt at reference period-end market exchange rates; this differs from valuation according to Suriname’s National Debt Law.

Read more at Fitch