Recycling Plastic Waste

Global Progress ?

eyesonindonesia

Amsterdam, July 18th 2022– Last month, mid-June 2022, more than 250 people working within the PET plastic value chain gathered in Brussels at the Petcore Europe Conference to discuss circularity and other important issues in the PET plastic value chain.

The rising prices of both PET and its recycled counterpart rPET are a concern of us all. However, it was emphasized that this has not (yet) deterred the momentum for sustainable and circular plastics.

A lot of the discussion centered on the circularity of bottle packaging. This was unsurprising, given that 97% of all PET products in the world end up in packaging, of which 70% ends up in bottles and 20% in trays.1 Throughout the value chain, steps are being taken to better enable PET packaging circularity. Progress has been made, though there is scope for further improvement via awareness campaigns, legislation, adoption of newer technologies, product design, and data collection leading to data-driven and science-based decisions. This article outlines five major takeaways from the conference.

An Image Makeover Is Long Overdue

Throughout the conference, it was reiterated that the plastic packaging industry is in need of an image makeover. It suffers from negative public perception and a false belief that its alternatives are better for the environment.

The Committee of PET Manufacturers in Europe (CPME) noted that, in fact, replacing plastic packaging with alternatives would, on average, increase packaging weight 3.6 times, energy use 2.2 times, and CO2 emissions, in turn, by 2.7%.

Plastic waste management remains an incredible issue.

It is being addressed by regulatory authorities, converters, retailers, brands, and several other players along the value chain. There is a lot of work being done behind the scenes to make plastic packaging circular and we need to raise awareness of it among end users.

However, if the industry attempts to raise this awareness itself, the risk is that the public would view their efforts as ‘damage control.’ Hence, the need for a neutral ambassador to vouch for plastic circularity.

Many concerned and well known people like Sir David Attenborough recently acknowledged the benefits of advanced recycling, resulting in an uptick of interest in the recycling of plastic waste.

The industry needs more of these ambassadors/influencers – especially those reaching a younger audience. Today’s youth are naturally more inclined toward making more sustainable choices. This is a generation that pushes governments to change, so keeping them informed is important. And that includes meeting them in their preferred platforms, like TikTok.

Call for Simpler and More Harmonized Legislation

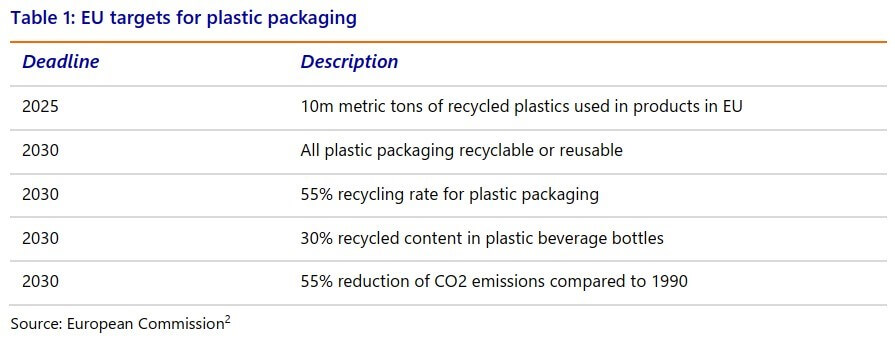

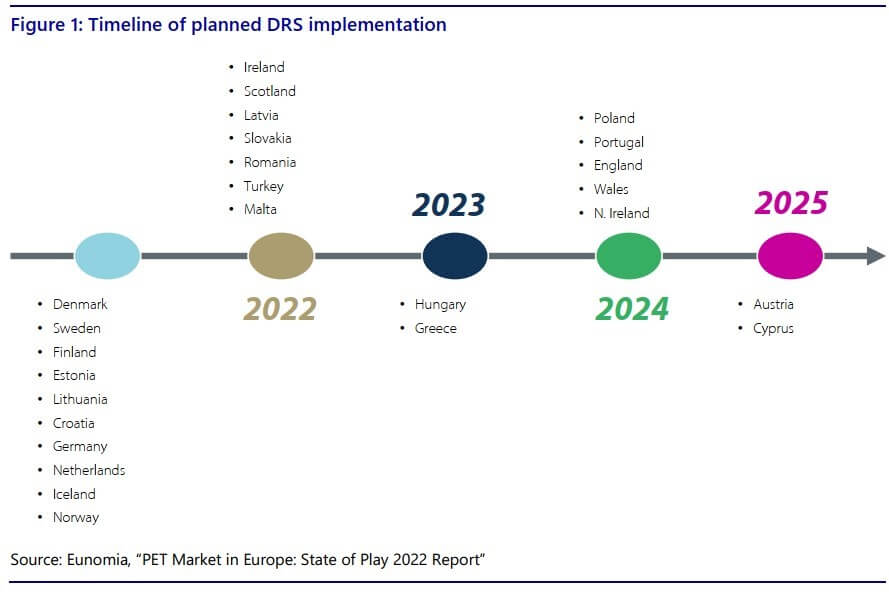

The EU has set several ambitious targets for plastic packaging, with several deadlines in and around 2025 to 2030. Recently, several directives targeting packaging circularity – such as the Deposit Return Scheme (DRS) – have been set in place across EU member states. But given that directives leave some room for interpretation, there are differences in the implementation of laws per member state. This complicates compliance along the value chain and, hence, there are calls for more harmonization of directives and/or regulation across all member states.

However and additionally, much of the legislation is interlinked, and perhaps even contradictory.

For example, the outcome of moving to reuse/refill models would mean less input available for recycling. This, together with the sheer amount of back-to-back legislation announced, has caused confusion in the market – hence, a call for simplification of legislation.

Sorting and Collection Rates Need To Improve

The Circular Plastics Alliance (CPA) estimates that meeting the EU’s target of 10m metric tons of recycled plastics used in products would require an increase in sorting capacities from 12.5m metric tons (2020 baseline) to 16.7m metric tons.3 Smart sorting technologies like the Digital Watermarks Initiative HolyGrail 2.0 can ensure good and efficient collection rates, thereby preventing PET from ending up in landfill or incineration and redirecting them for recycling.

Regarding collection, The Single Use Packaging Directive (SUPD) calls for a plastic bottle collection target of 77% by 2025 and 90% by 2029.2 To meet this target, EU member states need to substantially improve collections. As seen in the timeline above, many member states already have deposit return schemes, with more coming online by 2025.

Call for Experimentation and Transparency

Post collection and/or sorting, there are many sustainable routes packaging can take: It can be refilled, reused, or recycled. Whatever the route, the packaging must be adapted to accommodate the intended route. For example, Coca-Cola decided to move away from green (Sprite) bottles so as to not harm the recycling process.

There is need for more investment in tried and tested routes like mechanical recycling. Mechanical recycling will be the backbone of Coca-Cola’s ‘bottle of the future’ concept, according to Coca-Cola’s representative at Petcore. Coca-Cola also emphasized that it remains crucial to innovate, be creative, and continue to explore alternatives like bioplastics or chemically recycled plastics. Not surprisingly, Coca-Cola aims for its ‘bottle of the future’ to be made from 70% to 80% recycled PET from mechanical recycling and 20% to 30% virgin-like PET from depolymerization recycling or renewable resources by 2030.

A lot of the sustainability-driven changes in packaging design and technology are experimental and new. So Petcore attendees who partake in such experiments were urged to share their lessons learned along the way. Sharing data was particularly encouraged, as the entire value chain can benefit from data, of which there is a shortage.

Data also helps build trust through transparency – as do certifications. Currently a number of claims about recyclability and recycled content are self-assessments. These must move toward certified assessments by independent third parties like RecyClass.

The Risks

With all the progress with making PET circular, there are some risks. For example, in order to cope with targets, companies may look to secure recycled content from outside Europe.

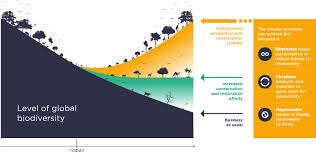

This challenges Europe’s circular vision. Another risk is downcycling. According to a presentation by the EU parliament, of the 1.8m metric tons of PET recycled, only 31% rebecome bottles. The remaining 69% ends up in products with lower quality or in products that are not recyclable, like textiles. Once PET is downcycled it cannot be reintroduced back into the bottle-to-bottle recycling process, thus losing its circularity potential.

Conclusion

The PET value chain is buzzing with circular activity and progress is being made along several fronts. This needs to be showcased to the consumer to reverse the preconceived negative image of plastic packaging. The pace of progress needs to accelerate in order to meet ambitious EU targets and more work needs to be done to capture quantifiable proof of progress – something that every player in the value chain should contribute to.

Capturing data and, in turn, getting certified via several independent third parties, can help build trust and a positive image in the eyes of end users.

And with that, we’ve come full circle.

eyesonindonesia